I have been itching to write about this very specific topic for time. As an early post, it may seem ambitious, but I have done the calculations and I am here to tell you this: start pulling your Social Security benefits as soon as possible. However, I have one caveat: invest it.

Since this blog is very early in its life, I must qualify my position on Social Security. It is:

- Unconstitutional

- Unsolvent

- Force

- a Lie (it is not guaranteed: see Fleming v. Nestor)

- Sucking the Financial Livelyhood from Younger Generations

- ...fill in the blank

That's right, I hate it; plain and simple. It goes against personal responsibility; it provides a false sense of security; it provides horrible returns; and what's worse, it is not guaranteed like the government tells you. I think personal accounts are a step in the right direction, but So-so Security really just needs to go away.

Now that we have that out of the way, I can give a brief overview of the different choices required when receiving Social Security benefits. Afterwards, I will give you the basic calculations that prove my point, which is, you should certainly begin receiving your benefits as soon as possible.

Regardless of whatever Social Security was supposed to be, or where it should go, it is now considered a safety net for retirement. When you have paid into Social Security for ten years, you begin receiving annual statements that explain what benefits you may receive. Along those lines, you have two ages that you can begin receiving benefits (unless you become disabled or die). There is an age that you can receive full benefits that starts at 65, but is stepped up based on the year of your birth. You can determine the age at which you can receive full benefits on your own. I am among the last tier that has to wait until the age of 67 to receive benefits. In the coming years, there may be more tiers. However, at the age of 62, you can receive reduced benefits. The reduction is based on the same tiers for full retirement benefits. The idea behind the reduced benefits is that you can receive these lower benefits, but it is probable (based on life-expectation) that you will be paid the same amount of benefits over your lifetime. However, this entire guide is really for those who are approaching that time in the very near future.

Now, I will give you a very simple and conservative set of calculations that will prove to you that you should indeed receive your benefits sooner, rather than later. Given that we are looking for those who will be 62 soon, we need to get the data from the tier for birth years 1943-1954. Full retirement age for these people is 66 and partial benefits will be reduced by 25%. What this means is that for every $100 in benefits you would receive at full retirement age, you will only receive $75 in benefits at partial retirement age. So, we have to make up for $25 for each block. For simplicities sake, we will assume that the full retirement benefit will be $100 per month, and the reduced benefit will be $75 per month. Regardless of the actual benefits, this will apply to your situation as long as the returns are the same.

This plan assumes that you start receiving partial benefits at the age of 62 and invest them getting a very conservative 8% return. What we will do is build an savings schedule. We have four years to meet the goal. If we meet the goal before four years, then you get that as early retirement! The goal is to replace the $25 reduction in benefits.

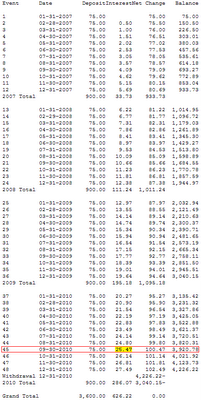

You can build savings/amortization schedules yourself using time-value software. Let's see the results:

On the 45th month, the interest paid on this money exceeds the $25 reduction. You have two choices, now. You can retire three months sooner with full benefits, or you can wait three more months and get more than full benefits.

Remember, this is based on an 8% return, which is highly conservative, but still not guaranteed. If you choose to do this, it is your own responsibility. I am not responsible for your outcome. That being said, you might exceed that 8% return, easily.

To me, this just proves how ridiculous Social Security really is. Use this to your advantage, because Social Security will be in a deficit situation in about ten years. This may mean a reduction in benefits or outrageous tax increases.

1 comment:

Who knows where to download XRumer 5.0 Palladium?

Help, please. All recommend this program to effectively advertise on the Internet, this is the best program!

Post a Comment